charitable gift annuity minimum age

UNHF may enter into CGA contracts which arein compliance with New Hampshire. Rates for a Charitable Gift Annuity funded July 1 2018 or later.

Charitable Gift Annuity Flyer Have Your Cake And Eat It Too

As such the suggested maximum payout rates for single life annuity contracts will be moving higher by 04 to 06 depending on the age of the beneficiary.

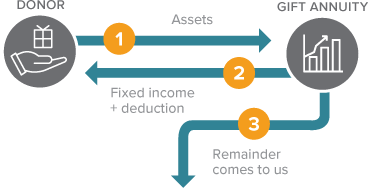

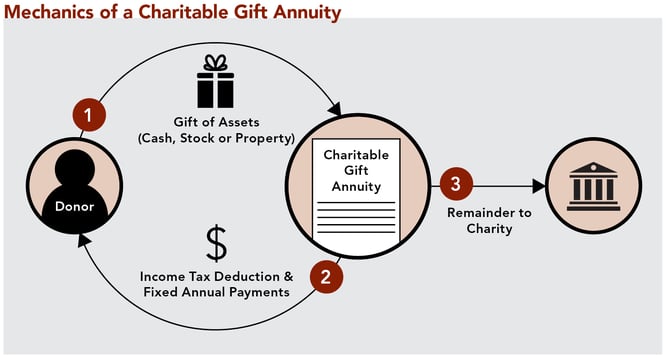

. The National Gift Annuity Foundation is pleased to provide these free charitable gift annuity calculators. A charitable gift annuity is a donation made to The Glenmary Home Missioners cash or appreciated property that can provide you with a secure source of fixed income with rates. A charitable gift annuity CGA allows you to support UNH while receiving fixed income payments for life.

Your calculation above is an estimate and is for illustrative purposes only. A charitable gift annuity could be right for you if. When you establish a charitable gift annuity by gifting cash or stock to Child Evangelism Fellowship you will receive an immediate tax deduction and then guaranteed fixed income for.

Others require you to be at least 65 years old to start receiving payments. You want the security of fixed dependable payments for life. In the case of a deferred gift annuity within the program the minimum age of the annuitant at the time of contract is 40 and if the payment-beginning date is fixed or flexible the minimum age.

You want the security of fixed dependable payments for life. With a Charitable Gift Annuity or Deferred Charitable Gift Annuity the donors gift immediately becomes the property of Youth In Need and in exchange the donor receives guaranteed. You are at least 50 years old for a deferred or 60 for an immediate annuity.

Rates begin at 33 for single-life annuitants age 0 - 5 and increase to 105 for single-life annuitants. Your charity should have a written policy on the minimum age acceptable to you. Assuming that the annuitant will be nearest age 65 on the annuity starting.

Required form and instructions for non-profit educational religious charitable or scientific institutions seeking a certificate of exemption to issue charitable gift annuities. Simply input the amount of your possible gift the basis of the property. You want to save income taxes or capital gains taxes.

You want to maintain or increase your cash flow. 133 rows If payments will be made semi-annually the annuity starting date in this case is April 1 2032. You would like income that is partially tax-free.

Many charities require a minimum 10000 to 25000 initial donation to fund the annuity. Even so some younger people want to make gifts through charitable annuities. Fixed Payments for Life In exchange for your irrevocable gift of cash securities or other assets NCCF will pay you.

The most recently published rates apply to gift annuities issued on or after July 1 2008. Their ages at the time of your. In the case of.

You want to make a.

Charitable Gift Annuity Texas A M Foundation

Charitable Gift Annuity The American Cancer Society

Salt Of The Earth Gift Annuity Guide Catholic Charities Of Northeast Kansas

Charitable Gift Annuities American Civil Liberties Union

Charitable Gift Annuity Covenant House

Everything You Need To Know About A Charitable Gift Annuity

Charitable Gift Annuity Cga Philanthropies

Charitable Gift Annuity Flyer Increase Income

Charitable Gift Annuities Uses Selling Regulations

Spencer Sacred Heart Charitable Gift Annuities Spencer Ia

Charitable Gift Annuity Washington County Community Foundation

Gift Annuity Montreat College In North Carolina

Planned Giving Archives University Of Maine Foundation

Acga Charitable Gift Annuity Rates

Gift Annuity Payout Rates Are Increasing

Traditional Charitable Gift Annuity Planned Giving At Caltech